- ASX finishes extraordinarily decently lowered after a mixed session

- Newmont and Fortescue shares go down on unsatisfactory updates

- KnowingTech proceeds its slide as financiers start to whine

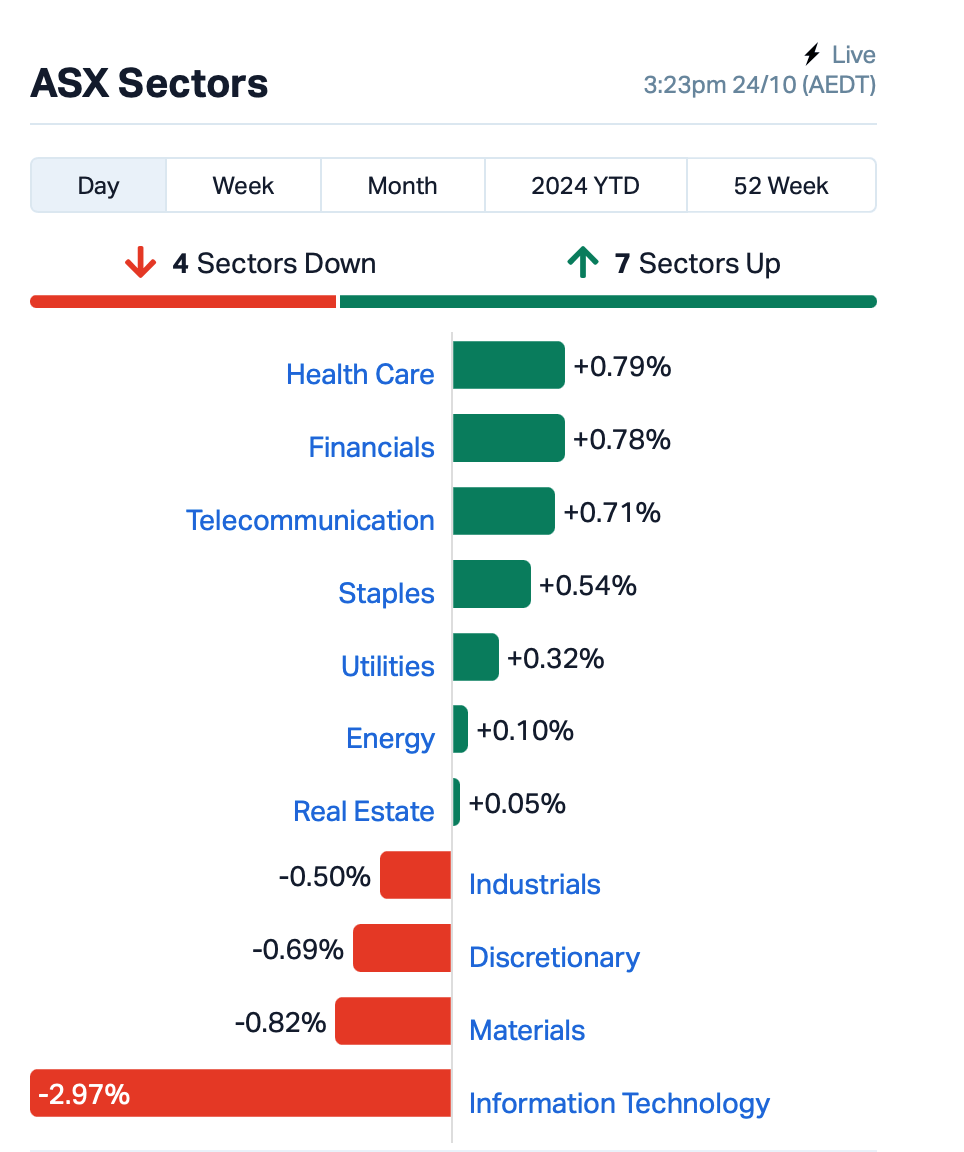

Aussie shares turned to a flattish shut right now after earlier losses.

Overnight within the United States, factors weren’t undue both, with the tech-heavy Nasdaq taking place 1.6% as expertise titan Apple claimed that its apple iphone orders have truly been down considerably.

Tesla shares, nonetheless, uploaded an 8% acquire in post-market buying and selling after its Q3 numbers went past specialists’ forecasts. The enterprise’s earnings elevated 17.3% year-over-year to $2.17 billion, sustained by a 6.4% enhance in car gross sales.

On the ASX right now, Telix Pharmaceuticals (ASX:TLX) assisted the Healthcare subject higher after growing 2.6%. Telix claimed it was relocating nearer to introducing its 2nd or third enterprise merchandise after the FDA permitted its New Drug Application for Pixclara, an evaluation consultant for gliomas (thoughts cancers cells).

Bank provides moreover assisted to boost {the marketplace} with Commonwealth Bank (ASX:CBA) seeing a 1.2% surge after a tough week.

However gold provides, along with some large cap names, had a tough time.

Newmont Corporation (ASX:NEM) and Brambles (ASX:BXB) uploaded less-than-great updates, dragging their share prices down.

Newmont dropped virtually 6% after its Q3 improve let down financiers. While gold manufacturing enhanced by 4% to 1.7 million ounces– about in accordance with assumptions– the enterprise reported higher-than-expected costs. As an consequence, its revenues per share of 81 United States cents missed out on the settlement worth quote by 5 cents.

Fortescue Metals Group (ASX:FMG) moreover went down over 3% after reporting a doc iron ore supply quarter, nevertheless there allowed drawback round costs and costs. Fortescue reported C1 costs of US$ 20.16 per damp statistics tonne (wmt), which was considerably greater than the settlement worth quote of US$ 19.20 wmt.

Super Retail Group (ASX:SUL), the proprietor of sporting actions retail model title Rebel, dropped virtually 5% after the enterprise claimed it’s going to definitely mark down much more objects to clear space for brand-new provide upfront of the vacation. Sales at Supercheap Auto, its greatest division, have truly particularly slowed down over the earlier 9 weeks.

Still in large caps, the embattled WiseTech Global (ASX:WTC) was dragging down the Tech subject as soon as extra, down a extra 6% complying with a 16% decline over the past 6 classes amidst discoveries regarding proprietor Richard White’s particular person life.

Across the realm, Asian provides primarily dropped right now as fret about China’s monetary expectation caught round, whereas the yen dealt with to climb after a three-day downturn.

In expertise info, Taiwan Semiconductor Manufacturing (TSMC) halted deliveries to a buyer due to worries regarding United States permissions; whereas competing chipmaker SK Hynix in South Korea noticed its shares climb after reporting doc revenues.

ASX SMALL CAP LEADERS

Today’s best finishing up little cap provides:

Swipe or scroll to reveal full desk. Click headings to kind:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IEC | Intra Energy Corp | 0.002 | 50% | 250,000 | $ 1,690,782 |

| DGR | DGR Global Ltd | 0.014 | 40% | 3,030,285 | $ 10,436,960 |

| OVT | Ovanti Limited | 0.029 | 38% | 97,108,236 | $ 42,633,057 |

| BNL | Blue Star Helium Ltd | 0.004 | 33% | 496,632 | $ 7,293,320 |

| CRB | Carbine Resources | 0.004 | 33% | 502,857 | $ 1,655,213 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 321,321 | $ 3,632,709 |

| ASQ | Australian Silica | 0.043 | 30% | 1,378,926 | $ 9,301,392 |

| OMX | Orangeminerals | 0.032 | 28% | 629,389 | $ 2,735,890 |

| GBE | Globe Metals && Mining | 0.047 | 27% | 2,400 | $ 25,609,661 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 734,996 | $ 57,867,624 |

| AKN | Auking Mining Ltd | 0.005 | 25% | 547,781 | $ 1,468,258 |

| HOR | Horseshoe Metals Ltd | 0.010 | 25% | 1,548,736 | $ 5,306,254 |

| LPD | Lepidico Ltd | 0.003 | 25% | 2,039,543 | $ 17,178,250 |

| SUH | Southern Hem Min | 0.040 | 25% | 638,810 | $ 23,559,681 |

| TMK | TMK Energy Limited | 0.003 | 25% | 1,025,042 | $ 15,183,224 |

| GRV | Greenvale Energy Ltd | 0.031 | 24% | 1,665,241 | $ 11,843,222 |

| WNX | Wellnex Life Ltd | 0.765 | 23% | 45,171 | $ 17,384,025 |

| CVR | Cavalierresources | 0.140 | 22% | 37,500 | $ 6,214,121 |

| BCB | Bowen Coal Limited | 0.009 | 21% | 21,812,119 | $ 20,513,428 |

| HTA | Hutchison | 0.029 | 21% | 52,473 | $ 325,740,206 |

| DME | Dome Gold Mines Ltd | 0.120 | 20% | 8,000 | $ 37,692,866 |

| AVE | Avecho Biotech Ltd | 0.003 | 20% | 6,565,978 | $7,923,243 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 1,317,549 | $5,831,140 |

Bowen Coking Coal (ASX:BCB) launched its quarterly right now, revealing that(* )has truly provided 769Kt ROM for the quarter, whereas the enterprise has truly taken care of a mining expense lower of seven% to $53/ROMt consisting of boxcut costs and 52% lower than this second in 2014. “robust mining performance” has truly resulted in 444Kt of salable coal created with gross sales of 415Kt videotaped within the quarter, at an peculiar coal price of A$ 216/t, down somewhat on pcp.That was growing right now on info that the enterprise has truly completed the acquisition of the

Auking Mining (ASX:AKN) uranium expedition activity in Grand Codroy,Newfoundland Canada activity consists of uranium mineralisation inside complete, organic-rich siliciclastic rocks resembles sandstone-hosted uranium areas within the western The, and expedition job has truly returned top-quality historic rock examples consisting of United States 153: >> 20,000 ppm (2%) Sample and 435ppm U, and Cu 3522: >> 20,000 ppm (2%) Sample and 400ppm U.Cu aware info that it has truly gotten in a binding farm-in contract with

Adelong Gold (ASX:ADG) (ASX: GDM) for an organized buy of as a lot as 51% charge of curiosity within theGreat Divide Mining Adelong Gold Project the contract, GDM is readied to spend $300,000 for a primary 15% threat in Under (complying with efficient due persistance), and will definitely make a extra 36% charge of curiosity upon attaining preliminary gold manufacturing from the reconditioned Challenger Gold Mines inside yr, bringing their full charge of curiosity to 51%.Adelong Gold Plant,

Earlier aware info that the enterprise’s Chimeric Therapeutics (ASX:CHM) 1B ADVENT-AML skilled take a look at has truly completed enrolment of fallen again or refractory Phase subjects within the dose-finding a part of the skilled take a look at. Acute Myeloid Leukaemia take a look at is an investigator-initiated analysis research presently accessible to enrolment at The of The University MD Texas underneath Anderson Cancer Center MD, Principal Investigator Abhishek Maiti within the Assistant Professor of Department.Leukaemia was using excessive up on the launch of its

Duketon Mining (ASX:DKM) quarterly file which explains of very early expedition duties presently underway on the September gold and lithium activity, 200km north of Barlee in WA. Southern Cross packages consisting of desktop laptop testimonials, space reconnaissance, mapping and rock-chip tasting get on the choose a wide range of inbound propositions from exterior third events being assessed too. Various’s tenement bundle exists alongside strike and beside Duketon landholding consisting of the Regis Resources’ (ASX:RRL), Rosemont and Garden Well money cow.Moolart Well suggested certified traders that its

TMK Energy (ASX:TMK) shuts tomorrow, 25 Entitlement Issue, at 5.00 pm AWST, with out expansions. October traders, consisting of the Many and Board, have truly revealed stable help for the deal, utilizing up substantial components of their privileges. Management, the 2nd pilot effectively (LF-06) is piercing at 226 metres in Currently, with extra updates anticipated as exploration proceeds. CHIEF EXECUTIVE OFFICER Mongolia urges all certified traders to think about this opportunity to hitch the enterprise’s success previous to the due date.Dougal Ferguson elevated after revealing favorable come up from its

Greenvale Energy (ASX:GRV) 5, carried out by the Liquefaction Test Program of University for its Jordan inAlpha Torbanite Project Queensland program meant to spice up the thickness of the asphalt merchandise, with outcomes recommending {that a} premium-grade C170 merchandise is perhaps attained with extra modifications.This examinations checked out quite a few issues, consisting of temperature degree and stress, to extend asphalt return and prime quality.

The thickness dimensions have been restricted due to little instance dimensions, the searchings for present that optimizing these issues may trigger an merchandise that satisfies the popular necessities. While will definitely at the moment assess the outcomes to decide on the next actions for the duty.The Greenvale Board claimed it was continuing with its twin itemizing on the

Wellnex Life (ASX:WNX) (LSE) after revealing methods inLondon Stock Exchange April enterprise successfully completed a positioning with UK financiers at $1.40 per share, revealing stable help for its motion. The anticipates to provide a substantial a part of its earnings from the UK and Wellnex, particularly with its Europe collaboration. Haleon enterprise is settling the required governing actions, consisting of these pertaining to its medical marijuana firm, and intends to complete the itemizing by the top of 2024. The outstanding primary convention held on 26 An accepted the issuance of shares to maintain this process, which will definitely enhance its worldwide visibility and financier attain.September,

And claimed it needs to have the flexibility to acquire its blood-based digestive tract most cancers cells evaluating examination to market.Rhythm Biosciences (ASX:RHY) a prezzo launched right now,

In states it stays within the Rhythm of the second-generation variation of its lead assay,“final stages of development” Colostat reveals fantastic assure in altering the contaminated Colostat, which is far much less exact and never particularly simple to make use of. ‘poo test’ federal authorities’s nationwide program provides completely free poo examinations for these aged in between 45 to 74. The the But variable suggests engagement is lowered which is a pity as a result of the truth that (a) it conserves lives and (b) this system units you again a sh * tload to run.‘ick’

ASX SMALL CAP LAGGARDS

‘s worst finishing up little cap provides:

Today or scroll to reveal full desk.

Swipe headings to kindClick%

| Code | Name | Price | ICU Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 0.003 | Investor Centre Ltd | -40% | 2,807,636 | $ 1,522,557 | CDD |

| 0.150 | Cardno Limited | -38% | 527,101 | $ 9,374,559 | RLC |

| Reedy Lagoon Corp 0.002 | -33% | 136,500 | $ 1,858,622 | TEM | |

| 0.006 | Tempest Minerals | -25% | 10,658,096 | $ 5,018,158 | PLAYTHING |

| R | Toys 0.050 Us | -23% | 299,517 | $ 9,832,040 | M4M |

| 0.012 | Macro Metals Limited | -20% | 38,596,382 | $ 54,346,604 | TZN |

| 0.080 | Terramin Australia | -20% | 615,767 | $ 211,656,272 | RIL |

| 0.004 | Redivium Limited | -20% | 760,250 | $ 13,734,274 | MOV |

| 0.170 | Move Logistics Group | -19% | 10,059 | $ 26,798,944 | IBX |

| 0.052 | Imagion Biosys Ltd | -19% | 354,529 | $ 2,281,379 | ARC |

| ARC | 0.100 Funds Limited | -17% | 87,582 | $ 4,695,104 | WHOLE LOT |

| 0.263 | Lotus Resources Ltd | -17% | 25,701,485 | $ 577,573,751 | PERIOD |

| 0.003 | Energy Resources | -17% | 11,932,307 | $ 66,444,898 | FHS |

| Freehill Mining Ltd 0.005 | -17% | 303,601 | $ 18,471,167 | GTI | |

| 0.005 | Gratifii | -17% | 156,000 | $ 12,895,177 | AIV |

| 0.011 | Activex Limited | -15% | 50,691 | $ 2,801,534 | RMI |

| 0.011 | Resource Mining Corp | -15% | 56,987 | $ 8,480,521 | SBW |

| 0.041 | Shekel Brainweigh | -15% | 142,517 | $ 10,946,939 | CTN |

| 0.003 | Catalina Resources | -14% | 1,000,000 | $ 4,334,704 | ILA |

| 0.120 | Island Pharma | -14% | 302,828 | $ 21,783,636 | LDR |

| 0.120 | Lode Resources | -14% | 822,731 | $ 14,949,780 |

IN INSTANCE YOU MISSED IT

has truly provided NPV and IRR quotes of as a lot as $1.2 bn and 79% particularly for its

Antipa Minerals’ (ASX:AZY) updated scoping study activity, highlighting the looks of a standalone gold-focused development.Minyari Dome 5 carried out by the

Greenvale Energy’s (ASX:GRV) Liquefaction Test Program of University has successfully Jordan with stable recuperation costs using a mixture of ore product sourced from its produced premium-grade C170 bitumen activity.Alpha Torbanite subsidiary

Suvo Strategic Minerals’ (ASX:SUV) has Climate Tech Cement with PERMAcast R&D for 50/50 possession of EcoCast executed a shareholders’ agreement and EcoCast Concrete to convey low-carbon concrete objects and jobs to market.Solutions has truly launched that it has truly participated in dedication letters, to safeguard $1 million in immediate financing through the priority of finance notes which can instantly change shares and alternate options, based mostly on investor authorization to be seemed for on the enterprise’s yearly primary convention on

Pursuit Minerals (ASX:PUR) 28 2024.November will definitely be primarily utilized to cash the recurring function on the

Proceeds activity, with a sure focus on continuing within the route of preliminary manufacturing of lithium carbonate from its 250tpa plant in Rio Grande Sur, along with Salta.“feasibility studies for the larger commercial operation and assessment of complementary acquisitions opportunities in the critical metals’ asset classes of lithium and copper”

TRADING STOPS

— pending a press release regarding an motion to an ASX

Brightstar Resources (ASX:BTR).Price Query– potential product deal.

Great Divide Mining (ASX:GDM)— pending a press release in reference to a urged funding elevating.

Orthocell (ASX:OCC)— pending a press release in reference to a urged funding elevating.

Mithril Silver and Gold (ASX:MTH) — pending launch of a press release regarding a funding elevating.

Lefroy Exploration (ASX:LEX)— pending a press release regarding a urged funding elevating.

Nyrada (ASX:NYR)— pending a press release in regard of a funding elevating.

QX Resources (ASX:QXR)— pending a press release in reference to a funding elevating.

Sultan Resources (ASX:SLZ)— pending a press release regarding a funding elevating.

Cosmo Metals (ASX:CMO)— complying with bill of product assay outcomes which requires time to place collectively and launch to {the marketplace}.

Asian Battery Metals (ASX:AZ9)— pending a press release regarding a funding elevating.

(ASX: HMC)Capital– pending a press release a few urged buy and an fairness elevating.— pending a press release in reference to a funding elevating.

we inform it like it’s.

At Stockhead, While Antipa Minerals, Greenvale Energy and Pursuit Minerals are Suvo Strategic Minerals entrepreneurs, they didn’t fund this submit.Stockhead’s

Today is obtainable you byClosing Bell Webull Securities (Webull Securities)Australia Pty. is a CHESS-sponsored dealer and a signed up buying and selling particular person on the ASX.Ltd submit doesn’t comprise financial merchandise ideas.

This must consider buying impartial ideas prior to creating any type of financial decisions.You SUBSCRIBE