Over the earlier 12 months, National Grid (LSE: NG) has truly gone up 2% on the London inventory market The National Grid share price is inside 6% of the place it stood 5 years earlier.

Things may be even worse. At the very least the share price has truly relocated the perfect directions.

For some financiers, the share price is likely to be pointless. National Grid is distinguished for its returns. Its setting within the power sector is regarded to produce regular capital that may help a reward the corporate intends to broaden in keeping with rising price of dwelling.

As a capitalist nevertheless, ought I to take that approach and consider merely the rewards?

Why a share price points

if I spend money in a share and the associated fee drops, I don’t shed something–unless I sell At that issue, a paper loss crystallises proper into an actual one.

So additionally if I bought National Grid shares immediately and the associated fee dropped (it’s down 13% contemplating that May 2022, for example) I might simply shed money if I price that price.

However, many financiers a technique or one other will definitely consider advertising and marketing shares. Even long-term shareholders may rework their financial objectives or sight of a enterprise, for example.

So a dropping share price generally is a drawback if it seems to be not more likely to recoup. Tying money up for years in shares which have a paper loss can likewise deliver an opportunity value as these funds can’t be utilized for numerous different factors.

How secure is the returns?

So I might undoubtedly pay attention to the National Grid share price additionally if I anticipated the rewards to keep up coming.

But energies aren’t as secure as some buyers suppose when it pertains to preserving their rewards, to not point out increasing them frequently.

Want an occasion? Look at SSE Last 12 months’s returns was 60p per share. Back in 2020, it was 80p. In 2015, it was 88.4 p. So loads for energies being trusted long-lasting returns payers. No returns is ever earlier than ensured.

Increasingly startling monetary debt levels

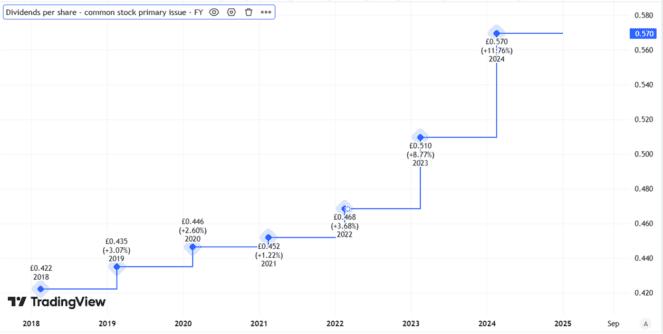

In justness, National Grid has a superb efficiency historical past when it pertains to yearly returns growth.

Created using TradingView

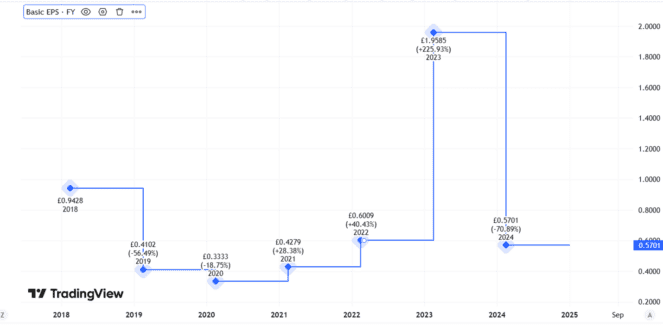

But contemplate the corporate’s basic incomes per share.

Created using TradingView

They stroll round an awesome deal– and don’t always cowl the returns.

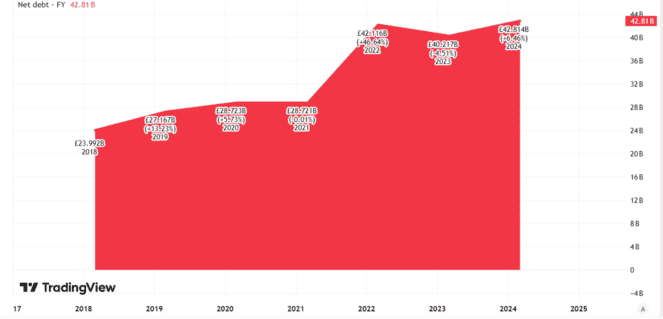

Owning and preserving an influence community is pricey service, particularly presently every time when energy is being produced and the place it’s being taken in stay in change contrasted to historic requirements.

That implies National Grid wants to take a position an awesome deal to keep up its service working. So its net debt has truly expanded in time.

Created using TradingView

Last 12 months noticed a civil liberties concern developed to assist improve funds supplied for issues consisting of capital funding. That thinned down buyers.

I see a hazard of a comparable relocate future if National Grid intends to produce on its goal of sustaining the returns increasing every year in keeping with rising price of dwelling. An choice, at a while, is for the agency to lower the cost like SSE has truly constantly performed. If that occurred, it could ship out the share price rolling.

So though its one-of-a-kind community properties can help produce appreciable capital, I’ve no methods to incorporate National Grid shares to my profile.