The steady drip, drip of enterprise being taken management of or delisted from the London Stock Exchange, and the absence of a pipe to alter them, is making it considerably testing to find superb, underestimated possibilities there. That suggests it’s much more essential for financiers to behave quickly and with sentence when possibilities emerge.

Filtronic (Aim: FTC) is one such risk. It is a UK-based developer and producer of high-performance radio-frequency microwave and millimetre-wave components and subsystems for the aerospace sector. Over the earlier years, it has truly taken a world-leading explicit area of interest on this fringe of {the marketplace}, and at present it’s profiting.

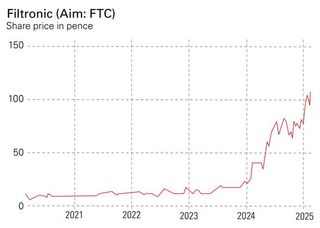

Filtronic’s modification in ton of cash

Historically, Filtronic’s 3 major places of process have truly been cell telecoms framework, safety and aerospace, and public safety. Orders from these industries gave a steady stream of earnings, but the corporate had a tough time to develop and to differentiate itself in a really inexpensive sector. Revenue gone stale, as did the shares. After Filtronic relocated from the first market to Aim in 2015, the provision rarely traded over 10p per share.

Subscribe to Money Week

Subscribe to Money Week at present and acquire your preliminary 6 publication issues undoubtedly FREE

Get 6 points free

Sign as a lot as Money Morning

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving strategies with our completely free twice-daily e-newsletter

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving strategies with our completely free twice-daily e-newsletter

The overview started to change in 2021 when European nations began elevating safety investing in response to Russian aggressiveness. The firm moreover started to herald price of curiosity from the space sector, as enterprise comparable to Elon Musk’s Space X began to launch satellite tv for pc constellations in elevating numbers. Space X and varied different discipline innovators have truly reworked to reduced-Earth orbit (LEO) satellite tv for pc constellations to perform worldwide safety at a portion of the worth of ordinary geostationary orbital satellites (GEO). LEO constellations make up numerous smaller sized satellites, which will be launched in large groups, mass-produced, and make the most of every varied different to reinforce array. Space X began releasing its Starlink LEO constellation in 2019, subsequently a lot it’s positioned better than 7,000 proper into orbit. As a number of as 55,000 LEO satellites is perhaps launched within the coming years.

Filtronic launched its preliminary assortment of agreements to supply LEO satellite tv for pc interactions instruments in 2023. One association was with the European Space Agency, value a complete quantity of ₤ 3.2 million, to create multi-frequency transceiver trendy expertise for satellite tv for pc haul feeder internet hyperlinks. The assortment of smaller sized agreements assisted the enterprise purchase a aspect within the market whereas reinvesting cash in r & d. These monetary investments completed in a transformational long-lasting collaboration association with Space X in April 2024.

Filtronic connecting arms with Elon Musk

SpaceX has truly linked Filtronic proper right into a discount to acquire its fingers on the enterprise’s E-band robust state energy amplifiers. These devices help floor terminals work together with Space X’s Starlink constellations and, due to this, are vital to the process.

Under the regards to the association, Filtronic supplied warrants to Space X, enabling the final to subscribe for as a lot as 10% of enterprise with a five-year vesting period. The warrants vested in 2 equal tranches based mostly upon the amount of orders– the preliminary after $37 million in orders and the 2nd on the equilibrium as a lot as a complete quantity of $60 million. Space X moreover set out put together for the long run era of those devices. The 2nd tranche of warrants is linked to the extra development of the trendy expertise.

In Filtronic’s 2024 fiscal 12 months, earnings climbed 56.3%, and incomes previous to price of curiosity, tax obligation, devaluation and amortisation (Ebitda) leapt 280%. In the preliminary fifty p.c of the enterprise’s 2025 fiscal 12 months, earnings climbed by 202%, primarily pushed by the Space X settlement. Following 2 years of growth, specialists at Cavendish had truly anticipated earnings to drop in financial 2026 because the preliminary stage of the settlement with Space X completed. Cavendish booked earnings of ₤ 48.4 million in financial 2025, being as much as ₤ 41 million in financial 2026. It anticipated growth to re-accelerate in financial 2027 because the 2nd stage of the Space X settlement started to settle. But on 10 February, Filtronic surprised {the marketplace} by revealing it had truly gained a brand-new settlement with Space X valued at $20.9 million (₤ 16.8 million) to be met in 2025 and 2026.

Filtronic grabs the celebrities

This discount was but another indication of precisely how transformational the Space X preparations have truly been and precisely how administration has truly launched the money cash to drive extra growth. Filtronic has truly spent drastically to meet the wants of its important agreements with Space X, and it stays to take action. The enterprise’s capital spending accomplished ₤ 2.1 million within the preliminary fifty p.c of the 12 months and is anticipated forward in at round ₤ 2.4 million within the 2nd fifty p.c of the 12 months. Even hereafter growth, Cavendish had Filtronic ending the 12 months with ₤ 10.4 million in web money cash, up 100% 12 months on 12 months. Thanks to the bespoke unique nature of its trendy expertise, its Ebitda margin was 19.2% in 2024 and anticipated to strike 28.3% in 2025.

Filtronic’s direct publicity to at least one key shopper is harmful, but it’s profitable clients, leveraging its expertise coping with Space X to achieve entry to varied different parts of the LEO market. Profit created from the cut price is moreover moneying substantial r & d to drive growth in varied different markets. Based on the enterprise’s most up-to-date discount, the provision is buying and selling at an onward price/ earnings (p/e) ratio of about 20 on a completely weakened foundation after eradicating out money cash. Even although the provision has truly climbed in value 10 instances contemplating that 2021, its present value isn’t additionally requiring, contemplating its market suggestion and merchandise base.

The enterprise is moreover a major procurement goal. Compared to varied different Space X distributors within the community interactions discipline, comparable to Taiwan- based mostly Wistron NeWeb Corp, Filtronic is a minnow and may find yourself being an especially interesting bolt-on procurement.

(Image credit score rating: Aim)

This write-up was preliminary launched in Money Week’s publication. Enjoy particular very early accessibility to data, viewpoint and analysis from our group of economists with a MoneyWeek subscription.