IN a cost-of-living dilemma the place all our bills boosting considerably, quite a few properties don’t earn money ample to reside pleasantly.

But the wonderful data is that over 15,000 corporations have really joined to the Real Living Wage.

This means that they willingly pay each one among their workers larger than the lawful minimal diploma.

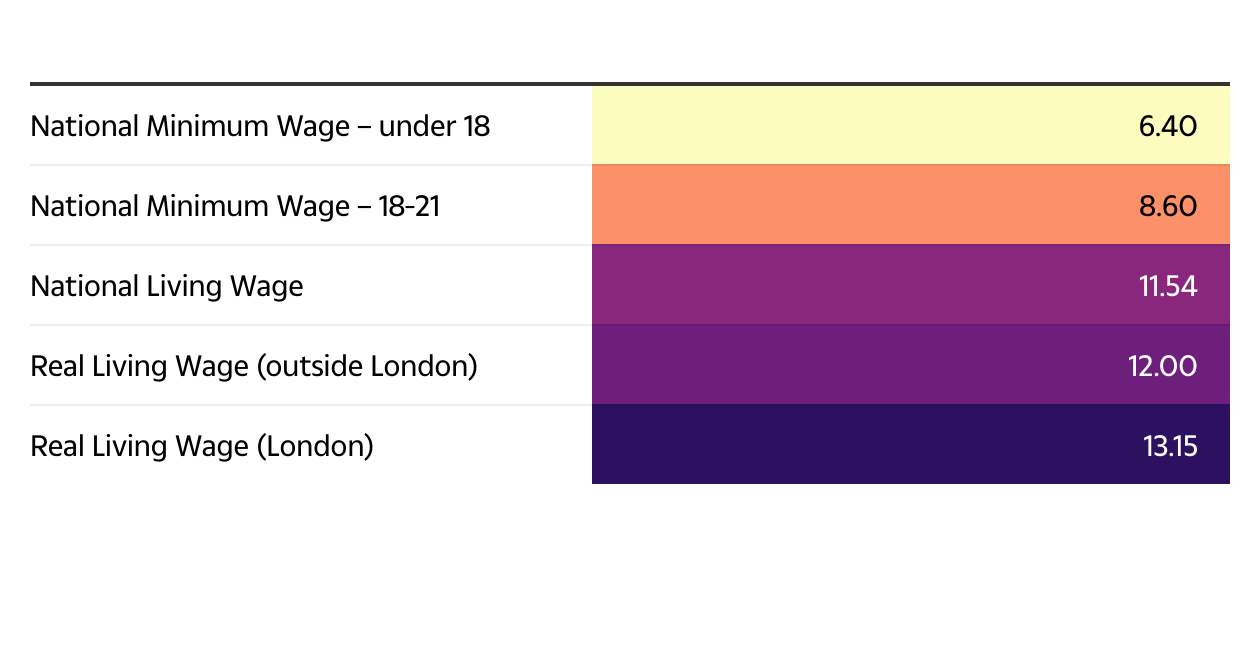

The Real Living Wage, which is set based mostly upon the expense of a basket of household merchandise and options, is ₤ 12 an hour past London and ₤ 13.15 an hour within the Capital.

It’s anticipated to be greater than the lawful want because it take into account that actual costs are greater than this.

By comparability, the government-set National Minimum Wage, the minimal pay-per-hour for workers matured in between 18 and 21, is presently ₤ 8.60 an hour.

Workers which can be beneath 18 simply require to be paid ₤ 6.40 an hour, as do pupils.

Once an worker transforms 21, they legitimately must be paid the National Living wage, which is ₤ 11.54 an hour.

But that is nonetheless ₤ 1,092 a 12 months a lot lower than an worker on the precise Living Wage will surely achieve, and ₤ 3,334.5 a lot lower than an worker on the London earnings will surely receive.

How is the Real Living Wage decided

The costs are decided yearly by think-tank The Resolution Foundation and managed by the Living Wage Commission, based mostly upon the simplest supplied proof concerning residing standards in London and the UK.

It makes use of a public appointment method known as MIS to inform the value. MIS asks groups to acknowledge what people require to have the ability to pay for at the least.

This is fed proper into an estimation of what any individual requires to achieve as a everlasting earnings, which is after that remodeled to a per hour value.

Living costs are lots larger in London than within the the rest of the UK, which is why the London Living Wage is greater than the UK value.

Rent is the important thing residing expense that triggers the differential in between each costs nevertheless it likewise thinks about little one care, touring costs, meals and household bills.

Everything you require to seek out out about the freshest base pay modifications

Who pays the Real Living Wage

The Real Living Wage shouldn’t be a government-set wage value, so corporations don’t must pay it. Any companies which can be paying it achieve this willingly.

The Real Living Wage Foundation states that there greater than 15,000 Living Wage corporations, consisting of fifty % of the FTSE 100, and household names reminiscent of Lush, Aviva, Timpson, Ikea and Liverpool Football Club.

There are likewise numerous small corporations that choose to pay it.

The guidelines of companies within the FTSE 100 that pay it are:

- 3i Group

- Admiral Group PLC

- AstraZeneca

- Auto Trader

- Aviva

- BACHELOR’S DEGREE Systems

- Barratt Development

- Barclays

- Beazley

- BP

- Burberry

- Convatec

- Croda

- Diageo

- Experian

- Glencore

- GSK

- Haleon

- Hargreaves Lansdown

- HSBC

- Informa

- Intermediate Capital Group (ICG)

- Intertek

- Legal and General

- Lloyds Banking Group

- London Stock Exchange

- M&G

- National Grid

- NatWest Group

- Pearson

- Persimmon

- Reckitt

- RELX Group

- Rightmove

- Sage

- Schroders

- SEGRO Plc

- Severn Trent

- Smiths

- Smith and Nephew

- SSE

- Standard Chartered

- Taylor Wimpey

- Unilever

- Unite Group PLC

- United Utilities

- Vistry Group

- Vodafone

- WPP

If you propose to study whether or not a sure firm is joined to the wage system, you may study rapidly by inputting the agency title proper into the Living Wage Foundation search tool.

How the lawful National Minimum Wage and Living Wages are altering

The Labour federal authorities is making modifications to the strategy the nationwide base pay is established, in a relocation which may see hundreds of thousands receive a pay surge.

It’s main step was to improve the remit of the Low Pay Commission (LPC).

The modifications point out that for the very first time, the unbiased physique will definitely take the cost of living proper into consideration when it makes future referrals to federal authorities on the bottom pay.

In the political election, Labour likewise assured to do away with the “discriminatory age bands to ensure every adult worker benefits”.

However, in July, the Business and Trade Secretary and Deputy Prime Minister suggested the LPC to tighten the void in between the bottom pay value for 18– 20-year-olds and theNational Living Wage

The federal authorities claimed that this can definitely be the first step within the path of achieving a solitary grown-up value.

Finally, the federal authorities assured to take care of the Single Enforcement Body and HMRC and assure they’ve the powers to make sure an genuine residing wage is accurately imposed, consisting of prices for non-compliance. So a lot, steps round this have really not been launched.

Chancellor Rachel Reeves claimed: “Economic progress is our first mission, and we are going to do every thing we will to make sure good jobs for working folks. But for too lengthy, too many individuals are out of labor or not incomes sufficient.

“The new LPC remit is an important first step in getting people into work and keeping people in work, essential for growing our economy, rebuilding Britain and making everyone better off”.

When was the bottom pay offered?

THE very first National Minimum Wage was established in 1998 by the Labour federal authorities.

It initially associated to workers aged 22 and over, and there was a special value for these aged 18-21.

A special value for 16-17-year-olds was offered in 2004, and in 2010, 21-year-olds got here to be certified for the grown-up value of the National Minimum Wage.

The value is established by the Government yearly based mostly upon referrals by the Low Pay Commission (LPC).