Photofex- AT/iStock Editorial by Getty Images

In July 2023, I initiated coverage for Jet2 plc (OTCPK:DRTGF) with a purchase rating and the availability has truly been succeeding returning 25.9% contrasted to a 19% return for the S&P 500. In this report, I’ll actually be going over some of the present revenues, give a menace analysis for the recreation agency and improve my price goal for Jet2 plc.

Jet2 Pre-Tax Profit Surges Despite Higher Costs

Revenues expanded by 24% to ₤ 6.255 billion. This was pushed by a ten% increase in skill and 9% much more vacationers flown. A substantial part of the event was acknowledged through much more bundle holidays belonging to the combination. The share of bundle holidays within the combine expanded from 64.9% to 68.3%. The number of bundle holidays purchasers expanded by 15% whereas flight-only vacationers lowered by 1%. On system earnings, the flight-only costs boosted 14% whereas bizarre bundle trip charges boosted by 11%.

Operating expenditures boosted 26% to ₤ 5.8 billion pushed by a considerable increase in resort vacation lodging costs, gasoline costs, higher repairs costs and higher personnel costs. The expense growth on almost all expense issues was higher than the flexibility growth. That was pushed by much more trip plans being supplied, but moreover was the result of boosted gasoline charges and proceeded labor expense stress. Maintenance increase dramatically due to the lease of aircrafts, which embrace higher repairs costs whereas there moreover was some expense altitude due to the maintenance of older aircrafts. This induced operating margins decreasing 100 bps to six.8%. Nevertheless, working earnings nonetheless expanded 9% to ₤ 428.2 million whereas EBITDA expanded 17% to 680.3 million.

In the FY24 outcomes, I see an indication that enterprise design with set because the core of enterprise is repaying. Jet2 is just not truly an airline firm, but it’s a agency that principally provides trip plans and as part of that bundle it flies recreation vacationers to their trip location.

What Are The Risks And Opportunities For Jet2?

The main hazard for Jet2 will surely be any type of lower wanted for bundle trip presents. In FY24, the bizarre measurement of holidays lowered from 7.8 days to 7.6 days which, I feel, is attributable to boosted costs for holidays pushed by rising price of residing and higher expense of residing that leaves a lot much less funds to be invested in holidays. Furthermore, the UK financial local weather is having a bumpy trip which might moreover affect Jet2.

There are moreover positives. Despite the stress, want for trip set is excessive, and whereas it could seem quite counterproductive, that does make good sense. The set tend to have truly significantly better costs contrasted to people scheduling journeys, transport, and resorts themselves. Jet2 is making use of its vary and provides trip presents at significantly better charges for recreation vacationers and at significantly better margins for itself.

Furthermore, the agency is absorbing further A321neo aircrafts within the fleet, which have distinctive gasoline shed numbers contrasted to the prevailing fleet together with decreased repairs costs. The A321neo aircrafts moreover seat further vacationers, notably 232 versus the 189 on the Boeing 737-800, which allows the agency to decreased per-seat costs. Over the next couple of years, the bizarre seat matter per airplane is anticipated to extend from 195 to 218, which must dramatically improve the expense effectiveness of the airline firm.

Jet2 Stock Offers A Compelling Investment Case

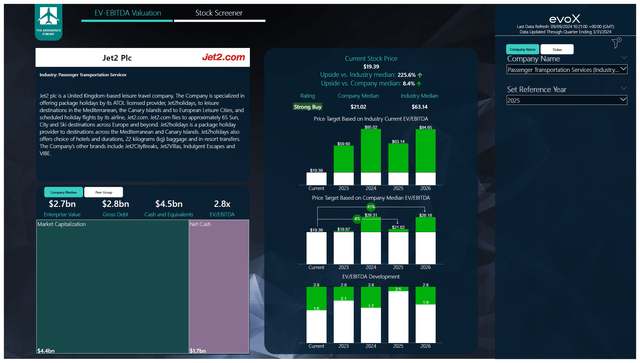

To establish multi-year price targets, we’ve truly established a provide screener which makes use of a mixture of skilled settlement on EBITDA, capital and some of the present annual report data. Each quarter, we overview these presumptions and the availability price targets appropriately. This data our analysis methodology.

For FY24, the fee goal had truly boosted to $28.33. This was pushed by the enterprise value of Jet2 persevering with to be pretty unmodified year-on-year whereas its outcomes remained to reinforce. For the years upfront EBITDA will definitely broaden at a worth of round 5.2%, but there will definitely be some stress on cost-free capital as Jet2 will definitely proceed absorbing brand-new aircrafts which will definitely increase capex. Nevertheless, I feel the availability is a strong purchase with a $21.02 price goal for FY25 and a $28.18 price goal in FY26, which I feel provides an interesting monetary funding occasion.

What Is The Best Way To Invest In Jet2?

I feel that previous to I am going over any type of outcomes or upside, it’s important to clarify that DRTGF provide is buying and selling OTC (Pink Current Information) and due to an absence of amount, it could possibly be robust for financiers to deal shares in most popular portions versus most popular charges. For those who have an curiosity in shopping for Jet2 plc provide, I will surely suggest looking on the JET2 ticker on the London Stock Exchange.

Conclusion: Jet2 Stock Is Underappreciated

I feel that Jet2 provide continues to be underappreciated at current levels. The service is coping with higher capex within the years forward and presently, there are nonetheless some inflationary costs approaching within the expense framework, but the agency is working with further efficient growth upfront, and it is only one of minority airline corporations that has an web money cash setting. With the current evaluation and the ahead estimates in thoughts, I protect my strong purchase rating on the availability.

Editor’s Note: This brief article opinions a number of protections that don’t commerce on a major united state change. Please perceive the risks related with these provides.