No one suches as to think about what happens after they go away, nonetheless there are some topics you merely cannot pay for to stop.

This is particularly actual when it pertains to your pension plan.

After all, you’ve got truly invested your life striving to build up that money, so if probably the most terrible happens, you want to assure it mosts more likely to people you respect.

For most private pension schemes your persevering with to be pot may be handed right down to your recipients. For the state pension plan, it’s a bit much more troublesome.

Here, Telegraph Money takes you through what you require to acknowledge:

What happens to your pension plan while you go away?

Passing away will definitely point out varied factors for varied kinds of pension plans. For occasion, unique pension plan settlements aren’t the like state pension plan settlements, and likewise the form of unique pension plan you’ve got will definitely be a big think about establishing what happens after you go away.

When you die you’ll actually both have the power handy down your pension plans to a recipient or it’d stop utterly, relying upon what sort of pension plan it’s and precisely the way it runs.

For most unique pension plan plans, your persevering with to be pot may be handed right down to your recipients. For the state pension plan, it’s a bit much more troublesome.

An important preliminary step is seeing to it you acknowledge what sort of pension plan you’ve got– you’ll be able to be taught what happens per form of pension plan listed under.

Types of pension plans

Here, we will definitely take you through the assorted kinds of pension plan and what it will probably point out for precisely how your individual operates fatality.

State pension plan

Your state pension plan will usually stop while you go away. However, in the event you go away a greater half, companion or civil companion they may have the power to acquire a number of of your allocation or acquire an uplift to their very own. Various features impression this resembling your age, whether or not you go away previous to or after state pension plan age, and in the event that they remarry or create a brand-new civil collaboration previous to they get to state pension plan age themselves.

If your companion bought to state pension plan age previous to April 6, 2016, they may have the power to boost their very personal state pension plan or purchase further settlements based mostly upon your National Insurance doc. If you delayed your state pension plan and had not asserted it while you handed away, they’ll purchase this additionally.

If they get to state pension plan age hereafter, the laws are a lot much less charitable. They cannot cowl up their state pension plan (unless they’re a woman and meet certain conditions) or acquire your delayed amount in the event you handed away previous to asserting it. However, they might nonetheless have the power to amass a number of of your state pension plan, based mostly on particular issues. There are nice offers of factors to take into accounts.

Jackie Spencer, head of money and pension plans plan and technique on the Money and Pensions Service acknowledged: “If you die, your civil companion or partner could possibly improve their fundamental state pension by as much as £156.20 per week [increasing to £169.50 from April 2024]. This relies on what they’re receiving as their fundamental state pension and your National Insurance contributions. They may even should be over state pension age.

“If you aren’t married or in a civil partnership while you die it could even be doable to your property to say as much as three months of your fundamental state pension, which can go to the beneficiaries. This is provided that you had not claimed your pension.

“There may also be some other money in the form of additional state pension, a protected payment, or extra state pension, or lump sum. This depends on whether you were in a marriage or civil partnership before 6 April 2016 and some other criteria.”

The Government offers a useful tool that you can tailor to your circumstances

Workplace pension plan

What happens to your workplace pension plan after you go away relies upon upon what sort of pension plan it’s. There are 2 main varieties; specified fee pension plan and specified benefit or final wage pension plan.

Defined fee pension plans

In a defined contribution pension (typically referred to as a “money purchase scheme”), you accumulate a “pot” along with your funds and people out of your firm that’s after that spent for you. The dimension of that pot while you retire establishes the diploma of earnings you’ll be able to acquire.

Ms Loveridge acknowledged: “If you die before drawing this pension, the whole pot can usually be passed on to your beneficiaries.”

While a specified fee plan doesn’t should be related to your work, it generally is.

Tom Selby, the pinnacle of retired life plan at AJ Bell, acknowledged: “If you have a defined contribution pension, such as a Sipp (self-invested personal pension), you can nominate as many people as you like to inherit your retirement pot, or portion of your pot.”

Final wage pension plans

The laws are varied for final wage pension plan plans, moreover referred to as defined benefit schemes, the place the pension plan is predicated upon your wage and the size of time you’ve got truly helped your organization. They are becoming rarer these days nonetheless round 700,000 people all through the UK nonetheless have one.

What happens while you go away will definitely depend on the regards to your pension plan, which could fluctuate relying upon the service. Different careers are moreover part of varied pension plan plans that embrace their very personal laws, such because the authorities, the NHS and educators.

Your technique would possibly stay to pay to a companion, dependant children, handicapped child of any form of age or others which might be monetarily relying on you. Your technique would possibly moreover consist of varied different benefits that can actually be paid to a recipient as a spherical determine, resembling a fatality in answer benefit. However, this can actually moreover be established by your service.

You should contact your service to make sure you more than pleased with what you’re leaving. Commonly, when you have no dependants, all settlements will definitely stop while you go away.

Drawdown pension plan

When you get to common pension plan age (presently 66), you’ve got the very same selections– withdraw it as a spherical determine, put it to use to amass an annuity or proceed with a drawdown. If you opt for a drawdown pension, you’ll be able to take money out of your pot as and while you require it. Meanwhile, the rest of the amount stays spent and stays to get value.

If you go away, your recipients will definitely have accessibility to your pension plan they usually have the very same selections. However, some funds don’t allow recipients to drawdown price financial savings equally because the preliminary proprietor so they may want to maneuver your fund to a service that does.

Options for recipients

Your recipient will usually require to name your pension plan service and educate them you’ve got truly died.

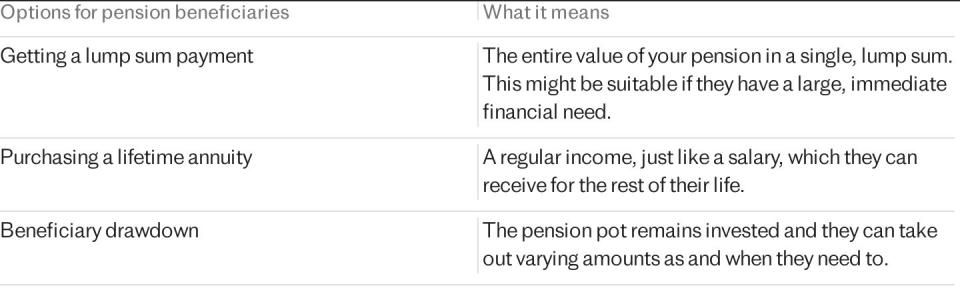

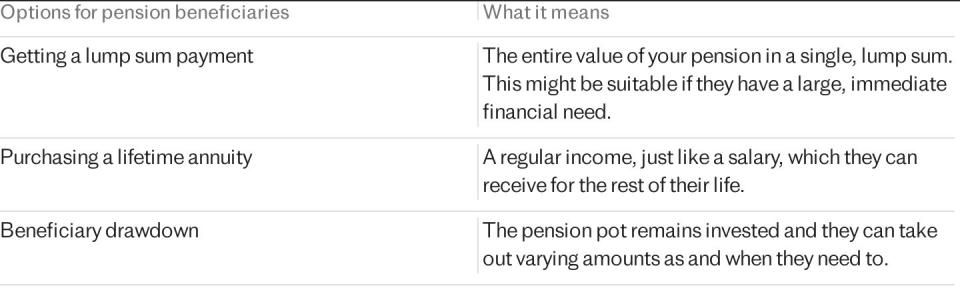

If you handed away previous to you attracted it they’ll actually have a variety to make: take it as a spherical determine, put it to use to amass an annuity or run it as a recipient drawdown. The full itemizing of selections for recipients is about out within the desk listed under.

Who could be a recipient?

A recipient is the person or people that can actually acquire your pension plan funds while you go away.

Sue Loveridge, financial organizer at Quilter acknowledged: “This can be anyone you want, though is typically a spouse, your children or other dependents.”

Exactly that earnings typically tends to be decided by what known as an “expression of wishes”.

Helen Morrissey, head of retired life analysis at Hargreaves Lansdown, acknowledged: “This form allows you to name who you would like to receive death benefits. Administrators and trustees will refer to them when dealing with your pension.”

It’s vital to take care of your ‘expression of wishes’ creates upgraded to ensure your methods are carried out. However, present examine from the Money and Pensions Service revealed that in 5 people actually didn’t acknowledge that they would definitely chosen to acquire any certainly one of their unique pension plans.

Ms Morrissey included: “If these are not kept updated there is a risk your benefits could, for example, get paid out to an ex-partner rather than your current one. This can cause huge financial pressures.”

It’s important to take one other have a look at these varieties complying with essential life events, resembling conjugal relationship and separation, to make sure the most effective particular person benefits.

Tax ramifications for recipients

Beneficiaries of your pension plan would possibly require to arrange for the tax obligation ramifications of what they acquire. Inheritance tax obligation doesn’t usually put in your pension plan because it’s dominated out part of your taxed property. If you go away previous to the age of 75 your recipients is not going to usually have to pay earnings tax obligation both. This is as prolonged because the money is accessed inside 2 years.

If the money is accessed afterwards, otherwise you go away after 75, they’ll have to pay their common value of earnings tax obligation.

Previously, there was an additional tax obligation payment for something recipients obtained from a pension plan over the Lifetime Allowance of ₤ 1,073,100. This was gotten rid of from April 6, 2023.

However, they’ll actually nonetheless require to pay earnings tax obligation on something they acquire over this amount. This places on a spherical determine additionally, the place they’ll pay earnings tax obligation on something over ₤ 268,275.

What if there are not any recipients?

If there are not any recipients, your pension plan service will definitely select. If you’ve got a close to relative your pension plan will usually most definitely to them. If you don’t, it enters into your property– and liable for property tax.

Conclusion: What you should do to arrange your pension plan

Ultimately, the selection of what happens to your pension plan after you go away is your individual so make sure you’ve got your picked recipients taped.

However, be aware that pension plans may be made advanced at the easiest of instances, particularly when it occurs the pot on others. Once you’re gone your loved ones may be restricted by the alternatives you’ve got truly made.

It’s always value fascinated about skilled recommendations to ensure your pension plan riches is handed down in accordance along with your wishes.

Frequently Asked Questions

Can my companion purchase my pension plan?

Yes, your pension plan service will definitely ask you to name recipients that can actually acquire your pension plan funds while you go away.

The recipient may be any individual you choose together with your companion, children or any form of dependents.

How can I assure my pension plan mosts more likely to my picked recipient?

You will usually choose your recipients while you enroll with a pension plan plan. However, you’ll be able to rework your thoughts at any second. Just contact your service, both by cellphone, weblog publish or looking via to your on-line account. It is not going to price you something and you’ll rework them everytime you resembling.

If you don’t name any individual, your pension plan service will definitely select. If you’ve got a close to relative it’s going to usually most definitely to them. If you don’t, it enters into your property– and liable for property tax.

You can moreover select to go away it to a charity.

When the second comes, your pension plan is not going to belong to your property– so it’s not coated by your will. Your service isn’t legitimately sure by your wishes, nonetheless will definitely take them proper into consideration.

Can I make use of a pension plan to lower property tax?

As your pension plan is not going to undergo property tax this may be a good way to avoid it when handing down money to your recipients. This is particularly useful when you have an enormous property, for the reason that life time allocation has been eradicated

Dean Butler, taking good care of supervisor of retail straight at Standard Life, acknowledged: “Despite ongoing hypothesis, the Government has thus far stayed away from lowering or abolishing inheritance tax. While this can come as a disappointment to some, there are different methods to guard the cash you hope to go to your family members.

“Pensions are perhaps chief among these – as well as being incredibly tax efficient, it’s a little-known fact that most sit outside your estate and so they’re not liable for inheritance tax. Following the removal of the lifetime allowance, people have the ability to save significant sums and benefit from tax-free growth of their savings within a pension.”

What happens to my annuity after I go away?

An annuity technique transforms your pension plan price financial savings proper right into a surefire earnings for a set amount of time, or completely. Your recipients’ selections will definitely depend on what you picked while you purchased the annuity, so it’s one thing you ought to research totally.

If you obtain a solitary life annuity, settlements usually will stop while you go away. However, you’ll be able to select attachments that provide continuing settlements for a set length or a spherical determine to your chosen recipient.

Some people purchase a joint life annuity, which supplies routine settlements for them and anyone else. Usually that is your companion and lasts until you each go away, nonetheless it will probably moreover be a child until they get to the age of 23. Payments will usually cease after that.