Super Micro Computer (SMCI) left to a unprecedented starting this 12 months as shares higher than quadrupled from January to mid-March This rise made Super Micro eligible for S&P 500 incorporation, with the trendy expertise tools provide (with net hyperlinks to AI) being included to the index on March 18, 2024. In data, that would definitely have been a enjoyable time to take earnings or Short the provision, as shares are down by higher than 50% ever since.

One of the numerous developments has really been the document by Hindenburg Research, which had troubling accusations in regards to the enterprise’s financial protection. In analyzing these accusations along with Super Micro’s rules I maintain a impartial rating on the provision.

Hindenburg Casts Doubts About Super Micro

The Hindenburg document is admittedly the main issue I’m impartial moderately than favorable on SMCI provide, and I feel it has really triggered hesitancy amongst a lot of AI provide consultants and capitalists.

The allegations are fairly easy. According to Hindenburg, Super Micro participated in audit management that included “sibling self-dealing and evading sanctions” Anyone that believes this appears a lot introduced would possibly need to remember that the SEC billed Super Micro with intensive audit infractions in August 2020. Hindenburg’s document moreover instructed that lots of the people included with that stated audit negligence are again on Super Micro’s group.

Hindenburg’s group talked to quite a few Super Micro salesmen and workers members when assembling their document. It doesn’t help that Super Micro postponed its 10-Okay declaring to look at interior controls quickly after Hindenburg went public with its points. While this might simply be a coincidence, the timing is uneasy. Looking again quite a few years, Super Micro had really fallen quick to submit financial declarations in 2018 and was rapidly delisted from the Nasdaq subsequently.

Near the beginning of this month, Super Micro overtly supplied a rejection of the allegations, with chief govt officer Charles Liang countering, mentioning that Hindenburg’s document had,“misleading presentations of information” Super Micro hasn’t supplied any sort of added declarations ever since.

Artificial Intelligence Growth Is Undeniable

Super Micro’s standing as part of the short relocating globe of AI is only one of minority elements that I’m impartial moderately than bearish SMCI provide. The superb leads for the enterprise’s service and the numerous nature of the Hindenburg accusations primarily counter every varied different.

It’s troublesome to acknowledge what’s real and what’s incorrect proper right here, but nearly all of folks yield that the AI market offers partaking improvement leads. Nvidia (NVDA) has really been publishing triple-digit year-over-year earnings improvement for quite a few quarters. Other expertise titans have really included skilled system proper into their core firms and supplied exceptional outcomes for his or her traders. For circumstances, Alphabet (GOOGL) noticed its cloud earnings surge by 28.8% year-over-year as a lot of firms hurried to develop their very personal AI gadgets.

The skilled system market is moreover forecasted to maintain a 19.3% intensified yearly improvement worth from at present up till 2034, in accordance toPrecedence Research The AI market must proceed to increase, which want to boostSuper Micro The enterprise must benefit from Nvidia’s improvement, which is why the enterprise uploaded excellent earnings and earnings improvement all through Nvidia’s climb. That’s what we noticed for quite a few quarters. We merely don’t acknowledge precisely how exact all of the numbers had been, if the accusations focusing on the corporate have high quality.

Super Micro Has Strong Financials at Face Value

While it’s troublesome to neglect Hindenburg’s accusations versus Super Micro, it’s nonetheless helpful analyzing the enterprise’s earlier quarterly outcomes. Shares had been taking place additionally previous to Hindenburg launched its document. While in March 2024 I instructed that SMCI provide encountered threats, I actually felt that shares supplied a major buying risk in late-summer, up till Hindenburg muddied that optimistic outlook.

For its final documented quarter, Super Micro uploaded web gross sales of $5.31 billion, standing for a 143% year-over-year dive. Meanwhile, earnings elevated by 82% year-over-year, attending to $353 million. At the second of the launch, my most important downside was Super Micro’s reducing web income margin. Super Micro presently trades at a 20x monitoring P/E proportion, comparatively ample to make up for any sort of extra disintegration in income margins. SMCI provide has a extraordinarily diminished 13.6 x forward P/E proportion, but with the present speedbumps (the Hindenburg document and DOJ examination) capitalists seems unwilling to bid the evaluation quite a few any sort of higher now.

We don’t but have substantial proof that Super Micro has really participated in any sort of misbehavior, as affirmed byHindenburg Their document, however, has really completely forged a shiner on the provision. I anticipate that Super Micro would definitely have dramatically outshined its financial 2023 outcomes additionally omitting any sort of misdealings.

The Department of Justice Is Probing Super Micro Computer

The Super Micro debate included a brand-new part on September 26, as data went throughout the cables that the united state Department of Justice is at present penetrating the enterprise. SMCI provide rolled an additional 12% on this data, and shares had been only recently buying and selling at a lot lower than one-third of their perpetuity excessive inMarch There’s a excessive threat/reward on the shares now, but the raised threats have really delegated me to the sidelines with a impartial rating.

Super Micro shares recovered by higher than 4% on Friday, September 27, recommending that a lot of capitalists suppose that the lasting risk for enterprise deserves the elevated unpredictability.

Is Super Micro Stock Rated a Buy?

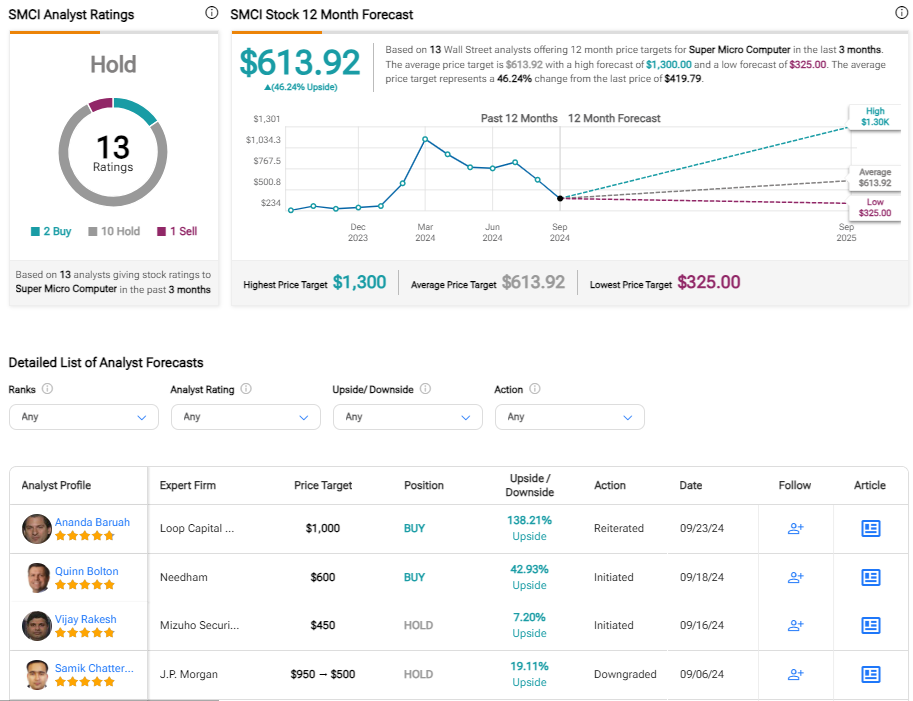

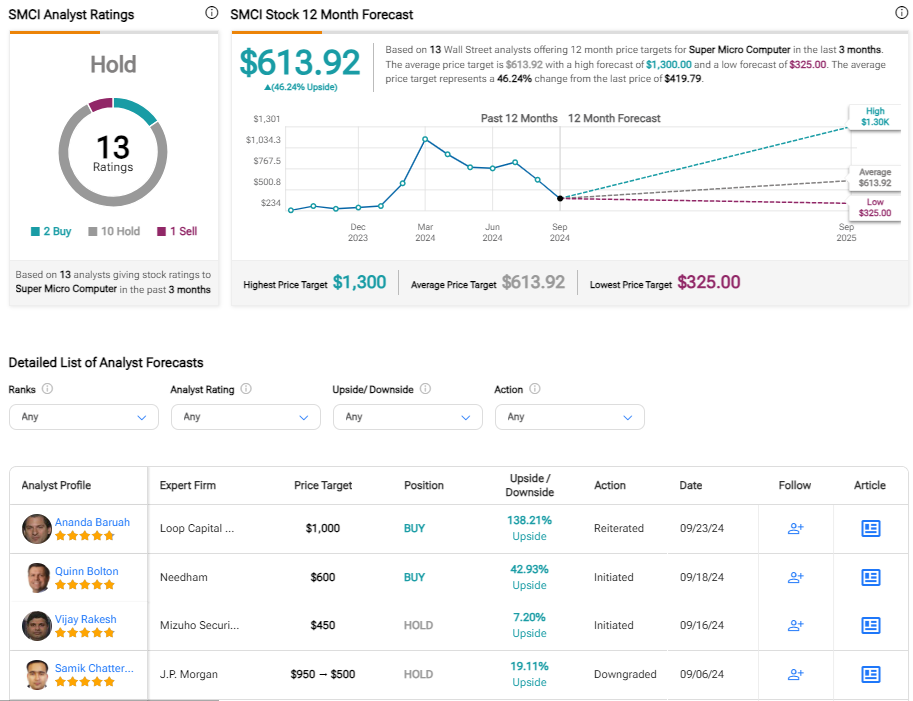

Although the rankings for this provide can rework promptly, Super Micro presently has 2 Buy rankings, 10 Hold rankings, and 1 Sell rating from the 13 consultants that cowl the provision. The atypical price goal for SMCI is $613.92, which suggests doable profit of virtually 50%. Again nevertheless, it’s pretty possible that quite a few analysis examine dealer brokers have really put their SMCI rankings beneath testimonial. SMCI provide does have a few small price targets consisting of $ 454, $375 and $325 from CFRA, Wells Fargo (WFC), and Susquehanna particularly. All of those price targets had been developed previous to the DOJ probe was launched, so additionally they’ll go down diminished.

The Bottom Line on SMCI Stock

There’s an outdated saying that recommends,“You either die a hero or live long enough to be the villain” That quote seems apropos for this enterprise. Super Micro made a lot of capitalists vital earnings all through its surge over a provide price of $1,000 per share. Those that went into the story late, consisting of after SMCI provide was included within the S&P 500, have really not prospered. Many capitalists are remaining on substantial losses now. Depending on what these capitalists do, it’s troublesome to tell simply how a lot additional downside Super Micro shares may need up till much more clearness on the challenges is obtainable.

If the enterprise’s present financials are exact, SMCI shares look pretty eye-catching proper right here. Shares can rise promptly if the Hindenburg document sheds significance, though that consequence onerous to anticipate. I’m an enormous follower of Super Micro’s market and repair doable pertaining to AI, which avoids me from being downright bearish. I’ve a impartial place proper right here. Meanwhile, I don’t anticipate shares of SMCI to rebound over $460 (the approximate price earlier than data of the DOJ probe) with no decision to each main dangers to investor price.

Disclosure