-

Market volatility will definitely stay raised for a number of years forward, Bank of America states.

-

The firm advises staying away from must buy the continual dip in expertise provides.

-

BofA relatively said to attempt to discover high-grade names, along with dividend-paying power and realty provides.

The market is acquiring additional unstable, and provides will definitely stay uneven for a number of years prematurely, based on Bank of America.

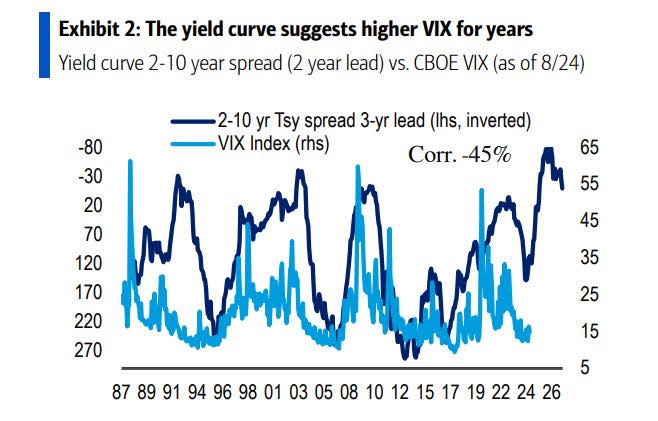

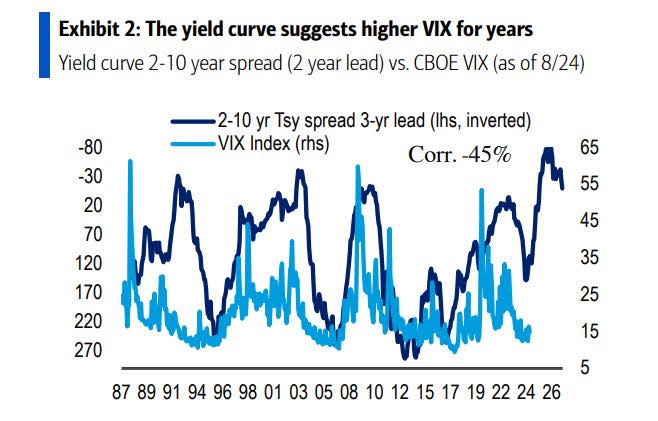

The firm states that within the near time period, election-related plan unpredictability will definitely keep {the marketplace} transferring. Looking moreover out with completion of 2027, the return contour is indicating additional volatility prematurely, as revealed by the graph listed under:

Further, an unique BofA “regime indicator” has truly turned proper into decline area.

With these parts in play, the corporate is advising protecting provides that usually surpass in instances of unpredictability or weak level.

“Quality, stability and income have protected investors in prior volatile markets. We recalibrate our sector calls to augment these characteristics,” specialists composed on Monday.

On the opposite aspect, financiers ought to remain clear of accelerating direct publicity to the distinguished expertise discipline, the monetary establishment alerted.

Even if charge swings help decrease mega-cap market names, quite a few prime qualities nonetheless make this mate an undesirable monetary funding, the monetary establishment said.

“Don’t buy the tech dip,” specialists said. “We remain underweight Information Technology despite arguments that it has gotten so beaten up.”

The monetary establishment talked about doc highs within the discipline’s enterprise-value-to-sales proportion, a sign that these firms proceed to be miscalculated. Meanwhile, expertise funds can shortly encounter straightforward advertising stress because the S&P 500 prepares brand-new index-cap insurance policies.

Specifically, the index is getting ready to lower the weightings of stock funds with $350 billion in assets, Bloomberg reported. In this event, straightforward monetary funding automobiles will surely must reorganize their holdings on the upcoming quarterly rebalance.

As volatility grabs for the long-term, top of the range and earnings must play a much bigger operate in profiles, specialists composed.

Although improvement provides made good sense when acquiring bills had been lowered with the 2010s, that is reworking– within the following years, the monetary establishment anticipates single-digit returns.

Quality direct publicity likewise makes good sense within the additional prompt time period, based on Savita Subramanian, BofA’s head folks fairness and quant method.

“Don’t be a hero,” she knowledgeableCNBC on Friday “Just to park in safe total return type vehicles where you get paid to wait.”

In a notice not too long ago, Subramanian stored in thoughts that at this time’s top of the range provides usually are not pricey, and people ranked B+ or significantly better are buying and selling at a light prices to their lower-quality friends.

Meanwhile, energies and realty rewards ought to herald financier focus as Federal Reserve interest-rate cuts go away them looking for return possibilities.

“Real Estate dividends are likely more sustainable than during prior cycles, given that since 2008, the sector has doubled its proportion of high quality (” B+ or Better”) market cap to a whopping 70%,” specialists composed.

Read the preliminary quick article on Business Insider