-

Nvidia will get on observe to strike a $10 trillion appraisal, professional Beth Kindig states.

-

Kindig is anticipating strong improvement and “fireworks” for the availability after its Blackwell launch.

-

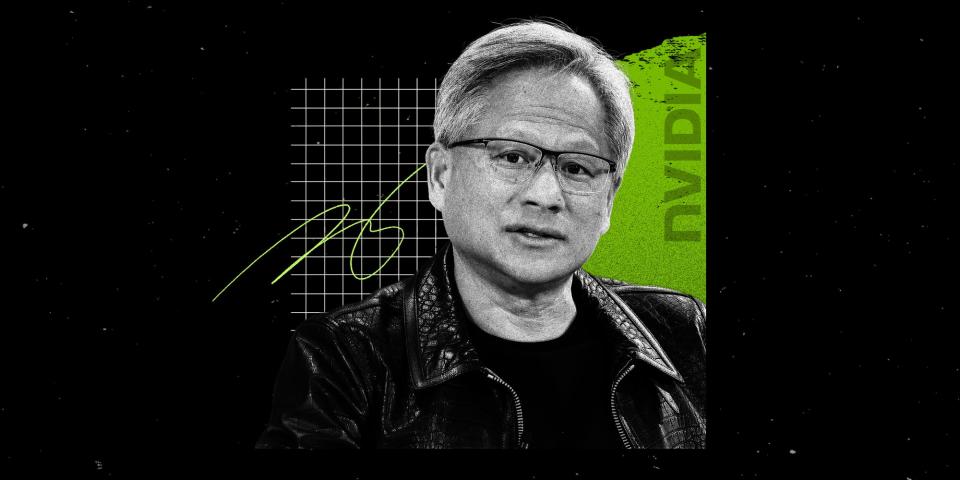

Jensen Huang ensured financiers on Nvidia’s next-gen AI chip, interesting “billions” in earnings.

Nvidia will get on observe to better than three-way in value, in accordance with Beth Kindig, the lead expertise professional at I/O Fund.

Speaking to Yahoo Finance on Thursday, Kindig acknowledged she predicts Nvidia scratching a $10 trillion appraisal over the long-term. That suggests beast beneficial properties for the $2.9 trillion AI titan, primarily due to strong anticipated improvement and beneficial properties from its next-generation AI chip, known as Blackwell, Kindig acknowledged.

Investors on Wall Street have really expanded apprehensive that Nvidia is coming to be miscalculated, supplied its substantial run-up over the earlier yr and financiers’ enormous expectations for revenues improvement. Nvidia shares dropped as much more than 6% Thursday after the agency beat earnings for the 2nd quarter, albeit much more immediately than earlier quarters.

Investors moreover have worries relating to Nvidia’s Blackwell chip after market consultants reported that the chip’s launch would be postponed by a few months due to “major issues in reaching high production volume.”

Kindig means that Nvidia’s outcomes have been nonetheless “great,” and ample to brush apart financiers’ worries heading proper into the outcomes.

Nvidia CHIEF EXECUTIVE OFFICER Jensen Huang defended the progress on Blackwell in a recent interview with Bloomberg, exposing that the agency made a “mass change to improve yield” and was wanting to attract in “billions of dollars” in earnings from the next-gen chip.

“That’s why things are being revised up and they were never revised down,” Kindig acknowledged of Nvidia quotes, together with that she stayed favorable on Blackwell’s upcoming launch. “They’re saying Blackwell is basically on time. Blackwell is not a concern. If anything, it’s extremely bullish.”

Kindig anticipated that Nvidia’s improvement trajectory ought to finish up being way more apparent as quickly as Wall Street consultants upwardly change financial quotes for the checklist under yr. That must be a “big moment” for Nvidia, complied with by the launch of supply amount numbers for Blackwell in 2025.

“That’s going to be fireworks, is how I would put it. Absolute, ultimate fireworks for Blackwell will come in Q1, with that Q2 guide,” Kindig acknowledged. “Early next year will be fireworks again for Nvidia, and we will be on track for that $10 trillion.”

Kindig’s projection for the chip agency is amongst one of the favorable, although Wall Street continues to be actually feeling assured relating to the chipmaker. Analysts have really supplied an strange fee goal of $151 per share, per Nasdaq info, indicating an extra 27% benefit for the availability over the next yr.

Read the preliminary publish on Business Insider