Everyone intends to find the next Tesla ( NASDAQ: TSLA) But buying {the electrical} car (EV) room might be powerful. Many EV corporations have really declared chapter for a few years, and dividing the nice from the dangerous might be powerful.

Thankfully, Tesla developed a transparent theme for fulfillment. And immediately, there’s one EV stock that appears exceptionally eye-catching. But there’s only one monetary funding strategy probably to prosper.

This is simply how Tesla ended up being a considerable success

In 2006, Tesla CHIEF EXECUTIVE OFFICER Elon Musk uncovered “The Secret Tesla Motors Master Plan” to most people. “As you know, the initial product of Tesla Motors is a high-performance electric sports car called the Tesla Roadster,” his essay began. “However, some readers may not be aware of the fact that our long term plan is to build a wide range of models, including affordably priced family cars.”

Musk summed up the plan of assault for Tesla:

Today, Tesla is an enormous signal of success when it pertains to implementing on long-lasting visions. The Tesla Roadster was successful, nonetheless provided its $100,000-plus charge issue, its market was always tiny.

Tesla required to confirm its manufacturing chops, and reveal most people that EVs is likely to be nice and attention-grabbing. It utilized this success to type, develop, and supply 2 brand-new designs: The Model S and Model X. These designs had been nonetheless pricey, nonetheless introduced Tesla to 1000’s of numerous brand-new proprietors.

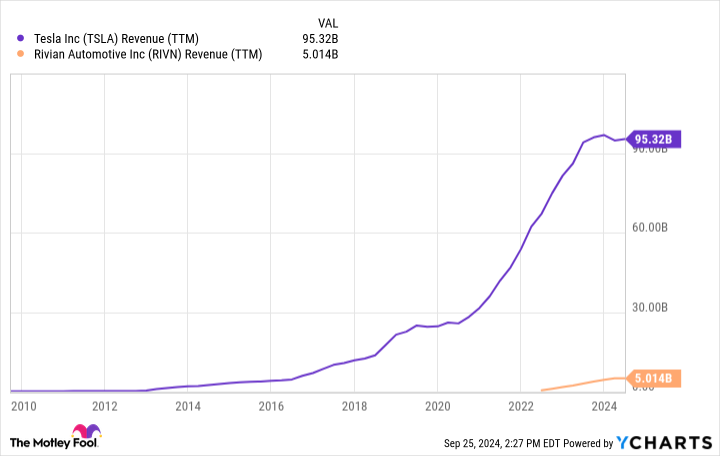

Tesla after that utilized its observe report and accessibility to funding to debut 2 brand-new mass market designs, the Model 3 and Model Y. These 2 designs, with much more economical charge components, enabled Tesla to develop its revenue by higher than 1,000% during the last years.

Tesla’s plan of assault functioned marvels for its analysis. The agency is presently price round $800 billion. Another agency, alternatively, is valued at merely $11 billion– but it’s implementing Tesla’s examined plan of assault completely.

Rivian is likely to be the next giant EV provide

When it pertains to complying with Tesla’s theme for fulfillment, couple of EV corporations look as eye-catching as Rivian ( NASDAQ: RIVN)

In 2018, Rivian revealed the launching of its R1T and R1S designs. Like Tesla’s earlier designs, the R1T and R1S had been ultra-luxury, high quality, no-compromise vehicles with charge components which may shortly exceed $100,000 with particular alternate options. Consumer feedback was fantastic. Consumer Reports found that Rivian has the best shopper satisifcation and dedication levels of any form of car producer– electrical or in any other case. Around 86% of Rivian proprietors claimed they will surely purchase a furtherRivian No varied different model identify was over the 80% mark.

What will Rivian end with its newly discovered observe report and gross sales base? Exactly what Tesla did: Build much more economical autos. Earlier this 12 months, the agency uncovered 3 brand-new designs: The R2, R3, and R3X. All are anticipated to debut with starting charges underneath $50,000. It was fulfilling this charge issue that aided place Tesla on the map for quite a few people. If Rivian can carry out, it must confirm actually efficient.

If Rivian can reproduce Tesla’s success, why is its market cap floating merely over $10 billion? First, its brand-new designs aren’t anticipated to hit the path until 2026 on the earliest. Second, the referred to as for manufacturing facilities aren’t additionally full but. Third, the agency remains to be shedding money at a fast clip contemplating that car manufacturing is funding in depth. However, monitoring anticipates to get to favorable gross earnings by the top of 2024. Finally, Rivian is trying to contend in a market part– electrical vehicles– that has really seen a number of private bankruptcies for a few years.

It’s clear that {the marketplace} is unconvinced of Rivian’s methods, though it’s implementing on a examined design for improvement, and has really proven its functionality to make vehicles that purchasers get pleasure from. The following couple of years, however, will definitely be essential. Rivian will definitely come to be a household identify like Tesla if it may carry out, an consequence that may probably see a fast improvement in its analysis.

There’s no guarantee that the agency will definitely protect its functionality to the touch funding markets economically or receive its manufacturing capacities up and working swiftly. It will definitely must market its vehicles in a hypercompetitive market. Yet it’s this unpredictability that gives shopper financiers with a worthwhile entrance issue for Rivian provide immediately. If you possibly can proceed to be shopper, Rivian’s surge may in the end mirror Tesla’s.

Should you spend $1,000 in Rivian Automotive immediately?

Before you purchase provide in Rivian Automotive, think about this:

The Motley Fool Stock Advisor professional group merely decided what they suppose are the 10 best stocks for financiers to accumulate at the moment … and Rivian Automotive had not been amongst them. The 10 provides that made it’d create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … in the event you spent $1,000 on the time of our suggestion, you will surely have $743,952! *

Stock Advisor affords financiers with an easy-to-follow plan for fulfillment, consisting of assist on developing a profile, regular updates from consultants, and a couple of brand-new provide decisions month-to-month. The Stock Advisor resolution has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 23, 2024

Ryan Vanzo has no setting in any one of many provides said. The Motley Fool has placements in and suggestsTesla The Motley Fool has a disclosure policy.

The Ultimate Electric Vehicle (EV) Stock to Buy With $1,000 Right Now was initially launched by The Motley Fool